In a bid to deal with a uncooked supplies scarcity and underperforming crops, high copper smelters in China collectively agreed to chop manufacturing in a Beijing assembly this week.

Sources with private data of the matter instructed Reuters that the quantity of cutbacks will depend on every smelter’s particular person assessments, as no particular charges or volumes have been imposed.

The information spurred copper costs upward, with the money contract on the London Metallic Alternate closing Friday (March 15) at US$8,790 per metric ton (MT) after starting the week on the US$8,520 degree.

The rise of simply over 3 % took costs for the bottom metallic to heights not seen since final April.

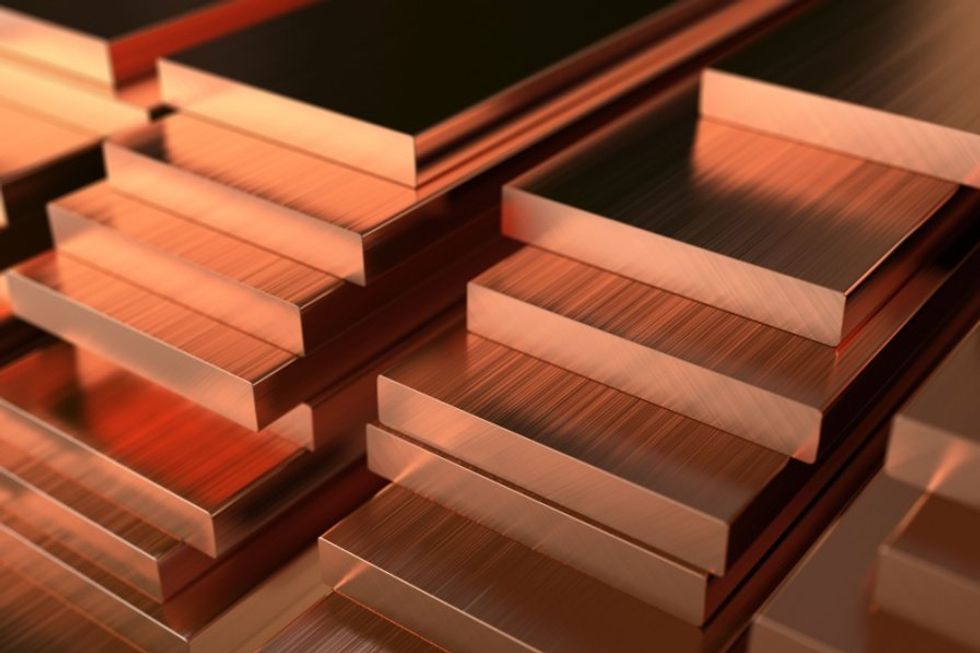

China is the world’s main refined copper producer and shopper, and its smelters are going through a essential scenario, with remedy and refining expenses (TC/RCs) having reached single figures. TC/RCs are the charges miners pay smelters to transform copper focus to copper cathode, they usually are likely to fall when copper focus provide runs brief.

That is as a result of smelters scale back TC/RCs to be extra aggressive when much less materials is obtainable. Nonetheless, reducing TC/RCs locations margin stress on smelters and may even depart them within the crimson as they obtain decrease compensation.

David Wilson, senior commodity strategist at BNP Paribas (OTCQX:BNPQF,EPA:BNP), instructed Bloomberg the plunge in charges has been pushed by the speedy growth of copper-smelting capability not solely in China, but in addition in India and Indonesia.

“This has much less to do with an absence of mine-supply development, and extra to do with an extra of smelting capability,” he stated. “That overhang of smelting capability isn’t one thing that’s going to be significantly useful for the copper value.”

Till lately, international recession issues have tempered specialists’ short-term forecasts for copper. Nonetheless, the late 2023 closure of First Quantum Minerals’ (TSX:FM,OTC Pink:FQVLF) Cobre Panama mine, which was a big producer, has impacted short-term projections, with some market watchers now predicting a possible copper deficit by late 2024.

Copper is used largely for industrial functions, however its position within the vitality transition is starting so as to add one other layer of demand, significantly from sectors like energy technology and electrical automobiles. With formidable local weather objectives driving renewable vitality adoption, the necessity for copper in infrastructure improvement is anticipated to develop considerably.

Do not forget to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Giann Liguid, maintain no direct funding curiosity in any firm talked about on this article.

From Your Web site Articles

Associated Articles Across the Internet

[ad_3]