Overview

Coniagas Battery Metals is a Canadian firm centered on creating a world-class essential minerals undertaking. The identify Coniagas is an acronym for numerous symbols on the periodic desk resembling – cobalt (Co), nickel (Ni), silver (Ag), and arsenic (As). The corporate is shaped from the spin-off of Nord Valuable Metals’ (TSXV:NTH) Graal property in Quebec.

The corporate is concentrated on advancing the Graal nickel-copper-cobalt undertaking in direction of manufacturing. Practically 16,000 meters of diamond drilling (along with the 6,885 meters of historic drilling) has been accomplished on the undertaking. The early-stage drill outcomes have been encouraging, intersecting as much as 1.12 % nickel equal (NiEq) over 28.9 meters at depths of solely 50 to 100 meters. The corporate plans to undertake an aggressive drilling program to develop the deposit space and ship a maiden NI 43-101 useful resource report.

Geologist Claude Duplessis holding a drill core of large sulphides containing nickel, copper and cobalt.

Coniagas can be planning to construct a processing facility in Quebec using its proprietary course of generally known as Re-2Ox. It’s a closed-loop hydrometallurgical course of that extracts metals with none discharge or smelting, thereby exceeding environmental compliance requirements. The processing facility will assist Coniagas convert the mined minerals into battery-grade metals.

The Graal undertaking represents a possible new nickel mine in Quebec with a number of benefits. First, the nickel at Graal is contained in sulfides which are simpler and cheaper to course of into battery grade nickel than nickel in laterite deposits. Second, mining at Graal might be an open pit, which may be very economical in comparison with different nickel sulfide deposits discovered deep underground. Third, the undertaking may even generate substantial copper and cobalt as by-products that can enhance the undertaking’s financial viability and ship a low-carbon, environmentally pleasant provide of essential metals for the power transition.

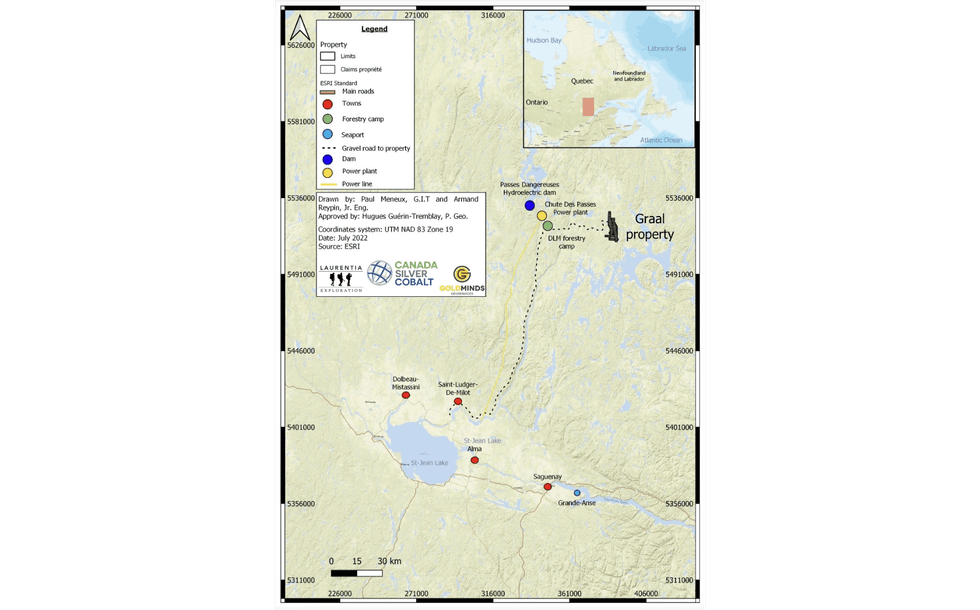

The undertaking’s location in Quebec additionally presents a number of benefits. The province is a Tier 1 mining jurisdiction and ranked eighth most tasty jurisdiction worldwide for mining funding within the Fraser Institute’s 2022 survey. Moreover, entry to glorious infrastructure by way of hydroelectricity, roads and ports is a big constructive.

The Graal undertaking suits completely into the Canadian authorities’s Crucial Minerals Technique that goals to create home provide sources of essential minerals within the nation. At the moment, the provision of those essential minerals is dominated by international locations resembling China, Russia, Indonesia, Peru, Chile and Congo, which both have rising tensions with the West or are characterised by political instability. Graal is in a a lot safer jurisdiction and is ideally positioned to turn into a dependable provider of fresh power metals.

The demand for essential minerals required for power storage and electrical car purposes is anticipated to develop by round 30 instances between 2020 and 2040, based on a report by the Worldwide Power Company. The report signifies copper demand to be 55 % increased than the 2022 provide. Likewise, the 2030 demand for nickel is anticipated to be 67 % increased than the 2022 provide, and for cobalt 147 % increased than the 2022 provide ranges. Coniagas is nicely positioned to learn from this supply-demand imbalance and gives traders a superb alternative to take part within the clear power transition.

A secondary undertaking, which can ultimately be introduced into the Coniagas portfolio, is the Lowney-Lac Edouard undertaking in Quebec, a potential nickel-copper property close to Rio Tinto. The undertaking is at the moment owned by Nord Valuable Metals, which was the mother or father firm of Coniagas.

Firm Highlights

- Coniagas Battery Metals is a Canadian firm centered on creating essential minerals resembling nickel, copper and cobalt.

- Coniagas Battery Metals was demerged from its mother or father, Nord Valuable Metals Mining (previously Canada Silver Cobalt Works), which introduced the separation of its enterprise in two – Nord Valuable Metals (centered on silver-cobalt) and Coniagas Battery Metals (centered on copper-nickel-cobalt).

- Coniagas’ flagship undertaking is the Graal nickel-copper-cobalt property in Quebec, Canada, with glorious infrastructure by way of low-carbon hydroelectricity, street entry and proximity to main battery manufacturing services in japanese North America.

- Coniagas intends to make use of a proprietary Re-2Ox processing know-how, a closed-loop hydrometallurgical course of that extracts metals with none discharge or smelting, thereby exceeding environmental compliance requirements.

- $6 million has been spent to date on the undertaking with historic drillings that produced extraordinarily encouraging outcomes, with geologists excited that it has the potential to be a big mine. The corporate will deal with exploration drilling in 2024 to develop the mineralized deposit zone and ship a maiden useful resource report.

- Crucial minerals are in excessive demand, pushed by their utility in electrical autos. Coniagas intends to develop right into a provider to the electrical car (EV) market.

- The Graal undertaking suits completely into the Canadian authorities’s Crucial Minerals Technique that plans to create home provide sources of essential minerals within the nation.

Key Tasks

Graal Venture

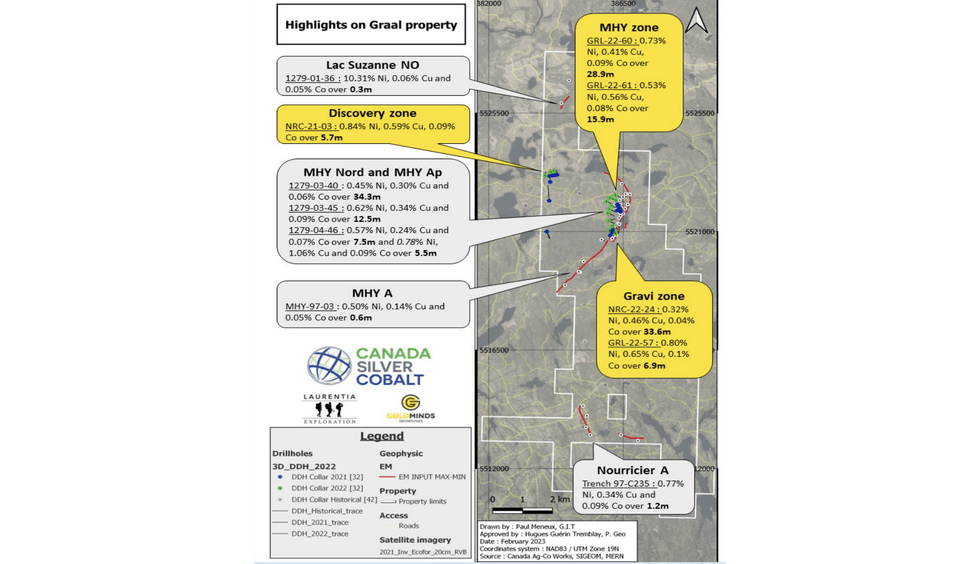

The pink line within the MHY-Gravi zones signifies the placement of the 6 km strike size.

The Graal undertaking is the corporate’s flagship nickel-copper-cobalt asset within the Quebec area. Quebec is a Tier 1 mining jurisdiction and gives a world-class surroundings for mining investments.

The undertaking is close to the Chute des Passes electrical energy plant and has good entry by roads. It’s near the deliberate Arianne phosphate mine, and is simply 200 kilometers from the ocean port of Saguenay on the St. Lawrence.

Preliminary exploration on the property has confirmed high-grade nickel-copper-platinum-group factor (PGE) deposits. The corporate has found a 6-kilometer strike size mineralized with near-surface high-grade copper, nickel and cobalt, together with a number of intersections to the west within the Discovery Zone.

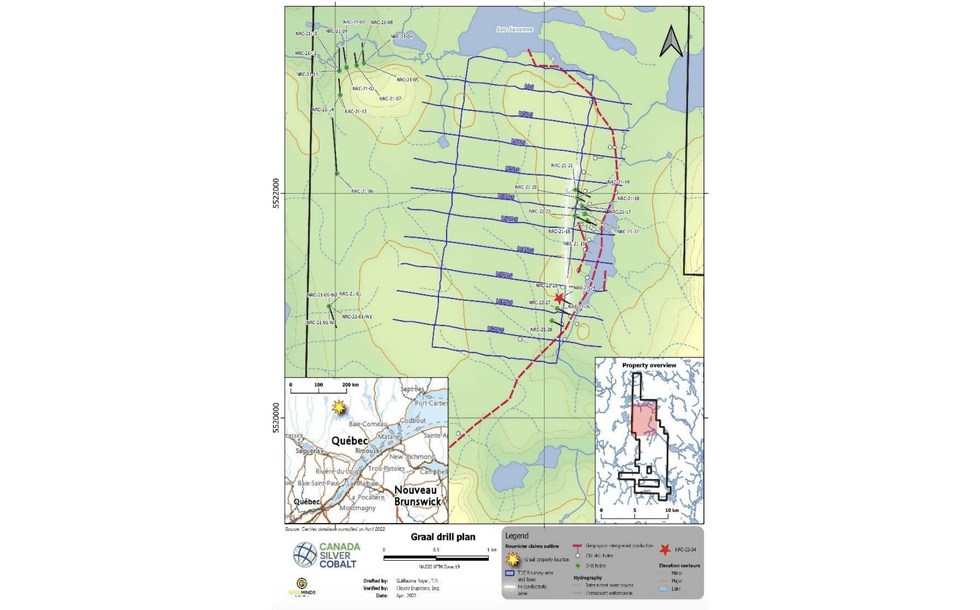

Primarily based on the drill and geophysics outcomes, the undertaking has the potential for a number of high-grade near-surface deposits and important deposits at depth. Earlier drilling between 1996 and 2004, carried out by SOQUEM and Virginia Mines totaling ~6,000 meters, indicated a possible goal of near-surface tonnage of 30 to 60 million tons with a grade vary of 0.60 to 0.80 % nickel, 0.30 to 0.50 % copper, and 0.10 to 0.15 % cobalt within the MHY zone. Moreover, Nord Valuable Metals drilled greater than 16,000 meters between 2021 and 2022 figuring out a number of drill targets.

The drill outcomes from the 2021-22 program found some noteworthy intervals exhibiting excessive grades of nickel and copper. This system succeeded in discovering wider intervals and continuity of nickel-copper sulfides throughout the MHY Zone. The important thing highlights embody 1.12 % Ni Eq over 28.9 meters and 0.94 % NiEq over 15.9 meters.

Transferring ahead, Coniagas will start drilling 2,000 meters in shallow areas to increase mineralization throughout the MHY Zone. Moreover, it plans to undertake a metallurgical research and interact in consultations with First Nations with an estimated price of $500,000. Constructing on this effort, Coniagas plans to ship a maiden useful resource estimate.

Lowney- Lac Edouard Venture

It is a secondary undertaking that will ultimately be introduced into the Coniagas portfolio. Located to the south of the traditionally productive nickel-copper Lac Edouard Mine, the Lowney-Lac Edouard property is adjoining to an space the place Rio Tinto, throughout a 2023 drilling initiative within the Savane area of a Midland Exploration property, uncovered high-grade nickel together with copper. The undertaking is at the moment owned by Nord Valuable Metals, the previous mother or father firm of Coniagas.

Administration Staff

Frank Basa – CEO

Frank Basa holds a BA in engineering from McGill College and is a member of the Skilled Engineers of Ontario. He has over 35 years of expertise in numerous features of gold mining and improvement. He additionally serves because the CEO of TSXV-listed corporations Granada Gold Mine and Nord Valuable Metals.

Aurelian Basa – Director

Aurelian Basa holds a bachelor’s diploma in geography from Concordia College, Montreal. He has over 10 years of expertise within the pure assets sector. He’s related to a platform that connects commodity merchants to sources of essential metals. He additionally manages a digital content material company centered on public mining corporations.

Ronald Goguen – Unbiased Director

Ronald Goguen has appreciable senior management expertise and has been related to Colibri Useful resource Company, Main Drilling and Beaver Brook Antimony Mine.

William D. Macdonald – Unbiased Director

William Macdonald has held a number of senior management roles and has been related to Landdrill Worldwide, Colibri Useful resource Company, Canadian Gold Assets and LEM Manufacturing.

Dianne Tookenay – Unbiased Director

Dianne Tookenay holds a Certificates in Mining Legislation from the Corridor Legislation College, a Grasp of Public Administration from Manitoba College, and a Bachelor of Administration from Lakehead College. She is a band member of Brunswick Home First Nation in Ontario and is related to Nord Valuable Metals and Granada Gold Mine.

Remantra Sheopaul – CFO

Remantra Sheopaul holds a B.Com. in accounting from Toronto Metropolitan College (previously, Ryerson College). He has wealthy expertise in numerous features of finance. He works with Marrelli Help Companies and can be a CFO of Granada Gold Mine, Canada Carbon, Angel Wing Metals and Metalite Assets.

Vincent Maltais – Company Secretary

Vincent Maltais holds a bachelor’s diploma in regulation and philosophy and political science from Montreal College. He’s a lawyer at Fasken Martineau DuMoulin the place he practices enterprise regulation and advises corporations on M&A and public company financing.

This text was written in collaboration with Couloir Capital.

[ad_3]