Overview

Demand for copper continues to be pushed by the continued industrialization and development of growing economies, along with international decarbonization tendencies; while the supply-side response and growth of latest copper tasks wrestle to maintain up with projected demand. Consequently, and additional exacerbated by the declining manufacturing of many main mines, the supply-side shortfall is predicted to proceed to widen considerably within the coming years, positively impacting copper costs.

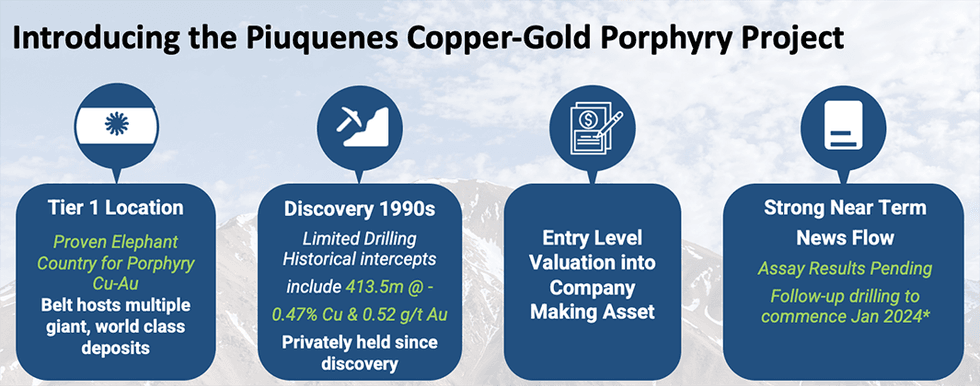

Pampa Metals (CSE:PM, OTCQB:PMMCF, FSE:FIRA) owns a portfolio of exploration property inside prolific copper belts in Chile and just lately expanded its portfolio into Argentina. The sport-changing acquisition of the Piuquenes Copper-Gold Undertaking in Argentina gives Pampa an significant presence in confirmed ‘elephant nation’ for copper and gold porphyry deposits.

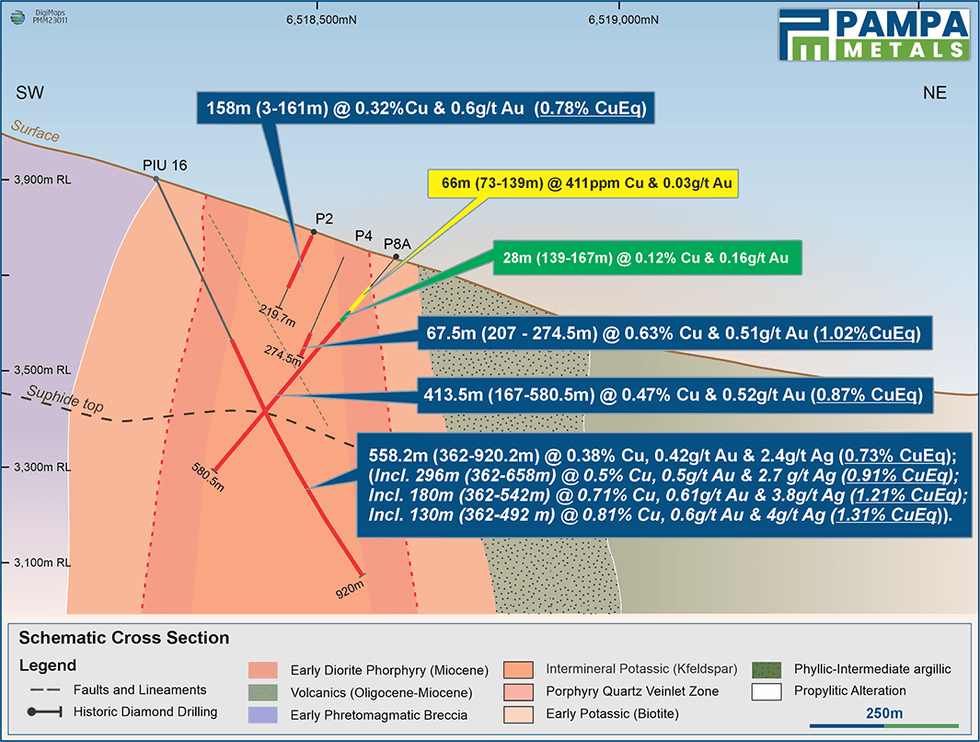

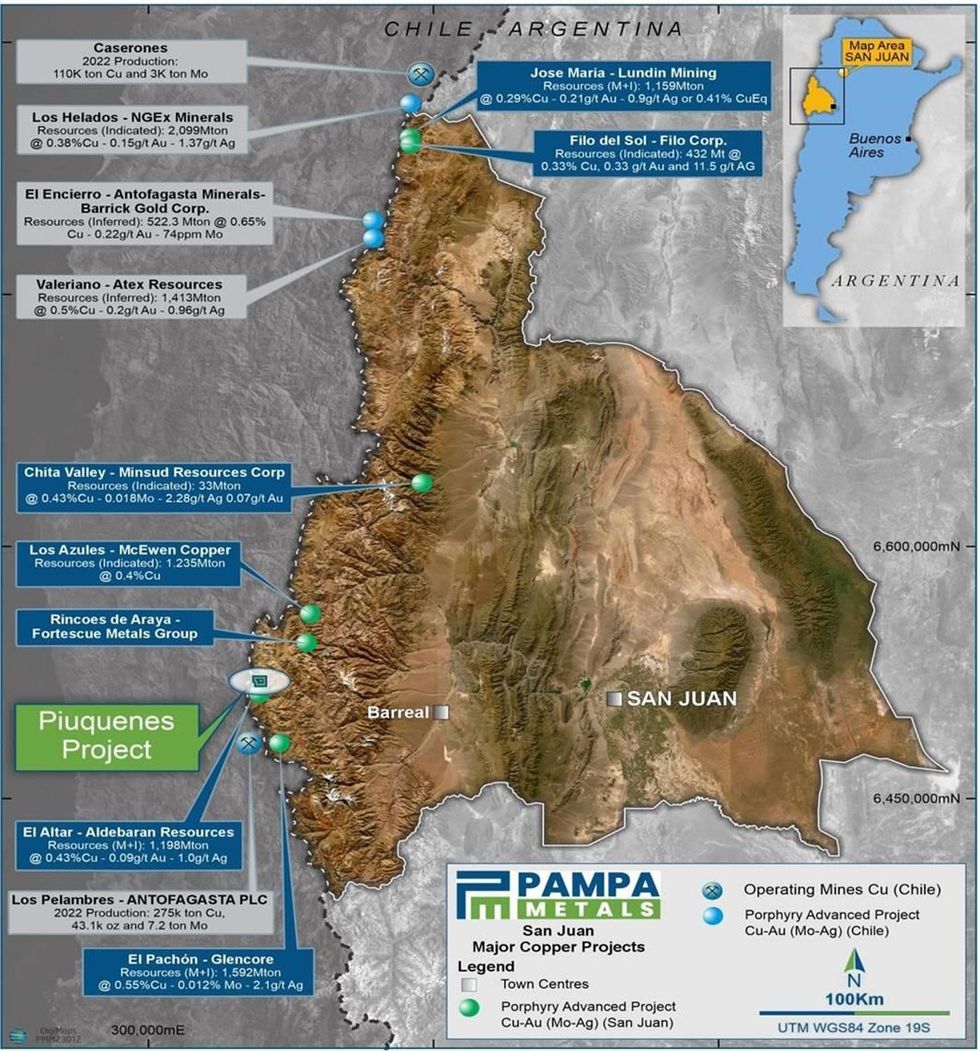

The Piuquenes Undertaking lies alongside the San Juan Miocene Belt, which hosts quite a few world class deposits, and is proximal to large-scale copper tasks, together with Glencore’s El Pachon and Aldebaran Assets’ Altar undertaking. The undertaking space consists of 9 mining titles spanning 1,880 hectares with glorious entry and is about 190 kilometers west of San Juan Metropolis. Since its discovery, the Piuquenes Copper-Gold porphyry has remained privately held. Historic intercepts at Piuquenes embody 413.5 meters @ 0.47 % copper and 0.52 grams per ton (g/t) gold. In 2016 Anglo American accomplished an exploration program on the property in 2016, which included a single, beforehand unassayed 920-meter diamond drill gap (PIU16 -DDH01). Anglo then reported 258 meters of visible mineralisation from 362 meters and a further 250 meters from 620 meters.

In December 2023, Pampa Metals reported the outcomes of the PIU16-DDH01 diamond drill gap which embody:

- 558.2 m (362-920.2 m EOH) @ 0.38 % copper and 0.42 g/t gold and a couple of.4 g/t silver (0.73 % CuEq)

Together with:

- 296 m (362 to 658 m) @ 0.5 % copper and 0.5 g/t gold and a couple of.7 g/t silver (0.91 % CuEq),

- 180 m (362-542 m) @ 0.71 % copper and 0.61 g/t gold and three.8 g/t silver (1.22 % CuEq) and 130 m (362-492 m) @ 0.81 % copper and 0.6 g/t gold and 4 g/t silver (1.31 % CuEq )

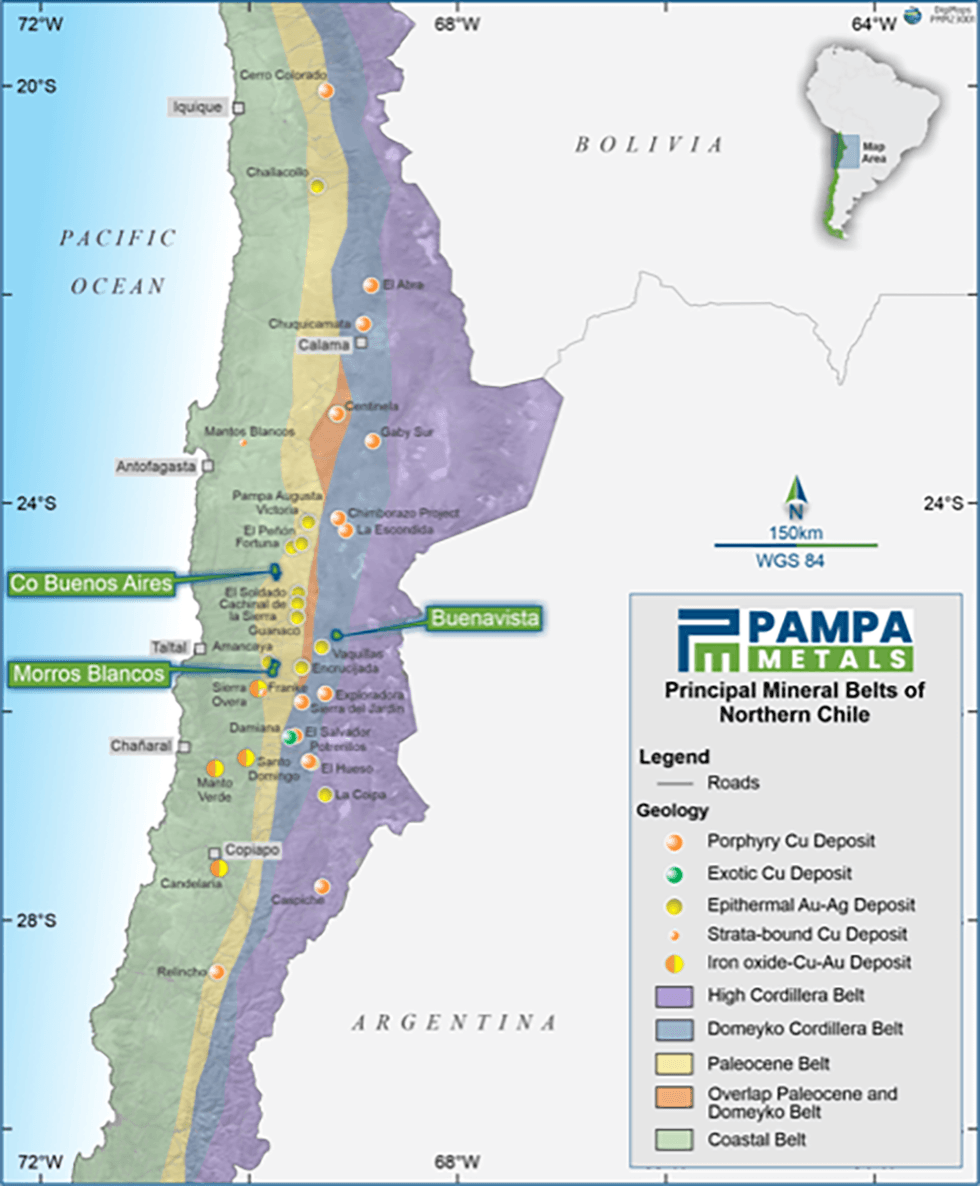

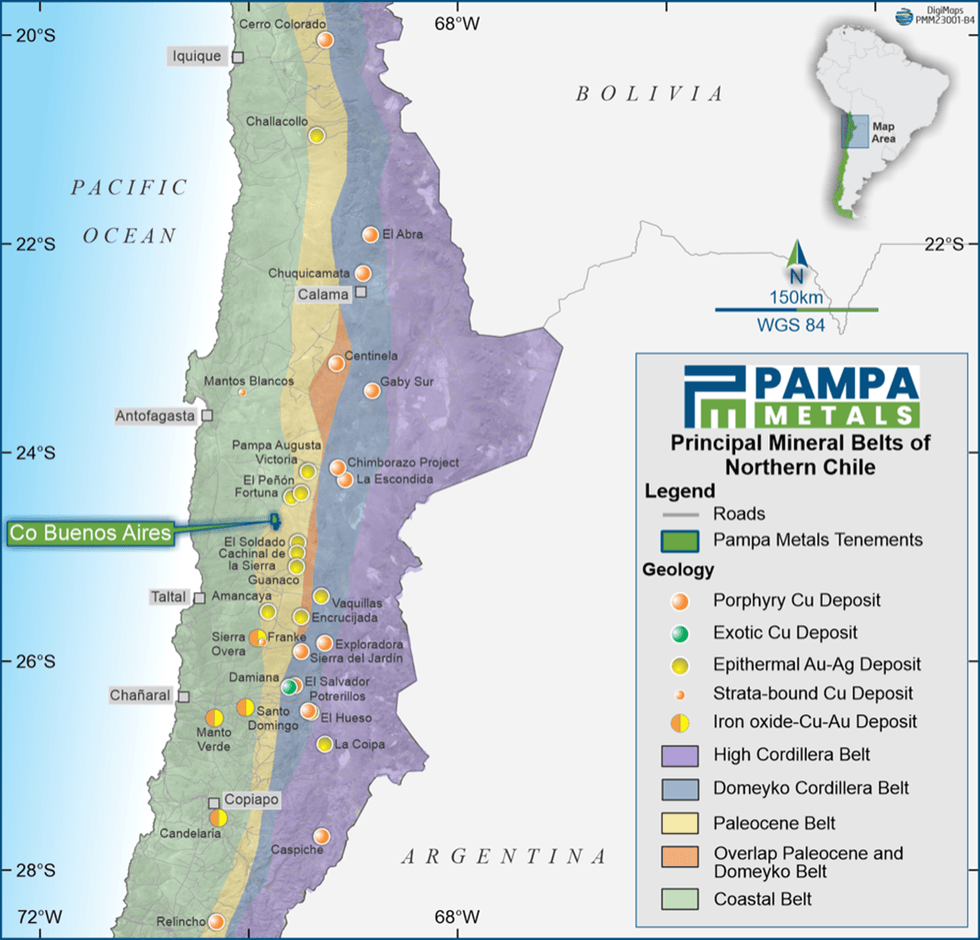

Pampa’s Chilean properties, Block 4, Morros Blancos and Cerro Buenos Aires, are situated alongside the Domeyko and Palaeocene copper belts in northern Chile. Chile has been the highest copper producer globally for the reason that early Nineteen Eighties, and accounts for roughly 27 % of international copper provide in 2021. The Domeyko Mineral Belt is the world’s most prolific copper belt and is host to 3 of the world’s high 5 copper mining districts. The Paleocene Belt additionally hosts globally important deposits and operations.

Pampa controls one of many few important, junior-owned land packages alongside the Domeyko Belt, offering its shareholders with distinctive publicity. The corporate’s Block 4 copper undertaking lies alongside the Domeyko Belt and hosts a number of untested, drill-ready targets, outlined by geology, geophysics, geochemistry and age-dating carried out by Pampa in recent times.

Firm Highlights

- Pampa Metals is listed on the Canadian Securities Trade (CSE:PM), Frankfurt (FSE:FIRA) and OTC (OTCQB:PMMCF) exchanges and wholly owns a portfolio of tasks extremely potential for copper, gold and molybdenum alongside confirmed and extremely productive mineral belts in Argentina and Chile.

- In November 2023, Pampa Metals made a game-changing acquisition of a brand new flagship undertaking in Argentina, the Piuquenes Copper-Gold Undertaking, situated alongside the San Juan Miocene Belt, which hosts quite a few world-class deposits, and proximal to giant scale copper tasks at El Pachon (Glencore) and Altar (Aldebaran Assets).

- Piquenes spans roughly 1,880 hectares with historic intercepts that embody 413.5 meters @ 0.47 % copper and 0.52 grams per ton (g/t) gold.

- In December 2023, Pampa Metals reported at Piuquenes 130 meters from 362 meters @ 1.31 % copper equal (CuEq), inside a broader interval of 558 meters from 362 meters @ 0.73 % CuEq which stays open at depth.

Key Tasks

Piuquenes Copper-Gold Undertaking

The Piuquenes Undertaking consists of 9 mining titles overlaying roughly 1,880 hectares within the prolific San Juan Miocene porphyry belt in Argentina, adjoining (to the north) to Aldebaran Assets’ Altar copper-gold porphyry undertaking, and fewer than 200 kilometers west of town of San Juan. Different giant porphyry copper tasks alongside the San Juan Miocene belt embody Glencore’s El Pachón (Glencore), roughly 30 kilometres to the south, the working Los Pelambres copper mine (60-percent-owned by Antofagasta), and McEwen Mining’s Los Azules, 50 kilometers to the northeast.

The primary proof of copper oxides at Piuquenes was reported in 1970 by Compañia Minera Aguilar S A, who subsequently accomplished the primary exploration program between 1973 and 1975. Between 1995 and 1997, Inmet Mining Company accomplished a heli-magnetic/radiometric survey, floor geology, rock and soil geochemistry, floor magnetics, PD-IP and eight diamond drill holes for a complete of 1,894.2 meters. Subsequently, from 2015 to 2016, Anglo American Argentina accomplished an exploration program which included a single, beforehand unassayed 920-meter diamond drill gap (PIU16 -DDH01).

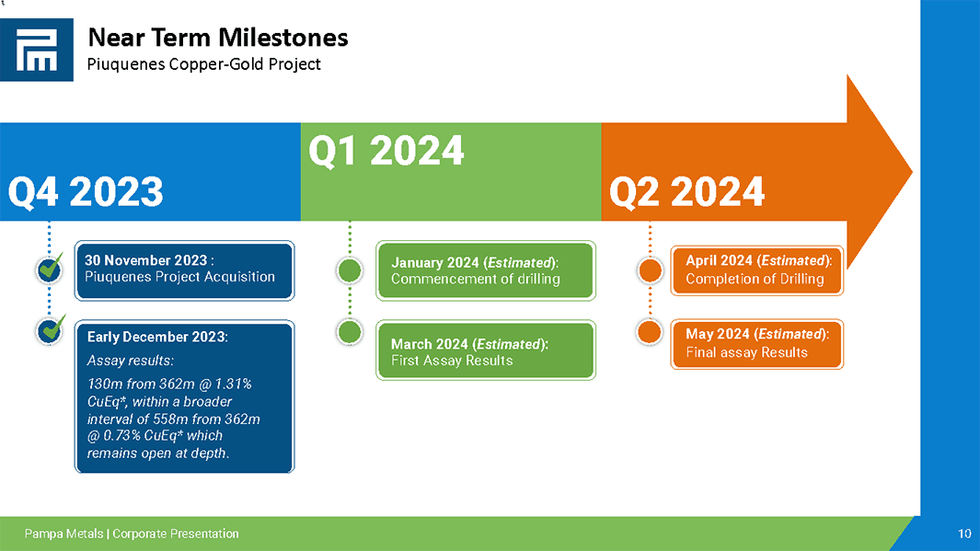

In December 2023, Pampa Metals reported the assay outcomes from the PIU16-DDH01 drill gap, which included 130 meters from 362 meters @ 1.31 % CuEq, inside a broader interval of 558 meters from 362 meters @ 0.73 % CuEq which stays open at depth.

Pampa has designed a diamond drill program to be accomplished throughout two drilling seasons which can be reviewed and finalized upon the upcoming receipt of the assay and QA/QC outcomes of Anglo People’ PIU16-DDH01 920-meter diamond drill gap.

Section 1 consists of a 2,500-meter diamond drill program designed to check the depth and lateral extension of identified mineralisation, to be accomplished between January and April 2024 with assay outcomes anticipated progressively between March and Could 2024. Section 2 consists of a six-month drill program designed to considerably develop the mineralised envelope and scheduled to start in October 2024.

Chilean Properties

Buenavista

Pampa Metals’ 100-percent-owned Buenavista undertaking, situated alongside the Domeyko Mineral Belt, hosts a number of untested porphyry copper targets. The undertaking covers over 6,600 hectares and is situated alongside pattern some 110 kilometers south of the key Escondida-Zaldivar copper mining complicated. The Buenavista Goal hosts dacite porphyry, proof for phreatomagmatic breccia, quartz-veinlet stockwork, quartz-sulphide breccia, and trenches containing copper-moly-gold-silver anomalies, with complementary geophysical anomalies. Extra targets are largely outlined by geophysical anomalies via post-mineral cowl and will recommend a cluster of porphyry techniques on the Buenavista property.

A 2,100-meter discovery diamond drill marketing campaign was accomplished in Q2 2023 and intersected hydrothermal alteration and mineralization indicative of the higher components of a porphyry copper system. Particular person samples reported most assay grades of 1.86 g/t gold (gap BV02-2023), 30 g/t silver (gap BV02-2023), 0.45 % copper (gap BV02-2023) and 1,715 ppm molybdenum (gap BV03-2023).

Cerro Buenos Aires

Pampa Metals’ 100-percent-owned, 7,000-hectare Cerro Buenos Aires undertaking is situated alongside the Paleocene Copper-Gold mineral belt in Northern Chile, alongside pattern from the key valuable metals district at El Peñon, in addition to important copper deposits similar to Spence and Sierra Gorda. The undertaking shows hydrothermal alteration typical of high-sulphidation epithermal and porphyry deposits over about 12 kilometers north-south. Restricted historic drilling has reduce each minor valuable metals and porphyry-related intercepts. Pampa’s work has highlighted a largely lined porphyry copper goal within the north, Cerro Chiquitin, primarily based on restricted geological outcrops, geophysics, geochemistry, and wide-spaced reconnaissance reverse-circulation drilling. The core goal at Cerro Chiquitin stays to be examined with diamond drilling. Different geochemical and geophysical anomalies on the massive property, typified by a widespread

Historic exploration campaigns at Cerro Buenos Aires have included geological mapping, geophysical surveys (heli-borne magnetics, heli-borne EM, restricted CSAMT), geochemical surveys over parts of the property (soil sampling, restricted rock sampling), and restricted historic, reconnaissance-style reverse-circulation drilling. Pampa has entry to those databases.

Morros Blancos

The 9,000-hectare Morros Blancos undertaking hosts a number of maar-diatreme complexes potential for high-sulfidation epithermal gold-silver, in addition to the undrilled, sub-cropping, Morro Colorado porphyry copper-gold-molybdenum goal. The undertaking is situated alongside the Paleocene Mineral Belt, which hosts main copper deposits in southern Peru and northern Chile, and is instantly east of Austral’s working Amancaya gold-silver mine, and alongside pattern from the large El Peñon gold-silver mineral district.

Morros Blancos shows hydrothermal alteration centered in three separate goal areas alongside a 15-kilometer hall oriented north-northeast, with traits of high-sulphidation epithermal gold-silver deposits. Geological options of specific curiosity embody maar-diatreme complexes, different widespread phreatomagmatic occasions, widespread superior argillic alteration, and floor geochemical pathfinder anomalies.

Administration Group

Joseph van den Elsen – President and CEO

Joseph van den Elsen is a twin Australian/Colombian citizen who presently serves because the chairman of Ronin Assets (ASX:RON) and has held a number of govt and non-executive positions with listed and unlisted mineral exploration and growth corporations together with Ookami (ASX:OOK), MHM Metals (ASX:VYS.), Ascot Assets (ASX:AZQ:), OAR Assets (ASX:OAR), Arcadia Minerals (ASX:AM7), Arkham Metals and Hampshire Mining. Earlier expertise additionally consists of serving as an affiliate director with UBS and holding a comparable place with Goldman Sachs JBWere. He graduated from LaTrobe College with a Bachelor of Arts and a Bachelor of Legal guidelines and later graduated from the College of Melbourne with a graduate diploma in setting, vitality and assets regulation, and from Curtin College with a graduate diploma in mineral exploration geoscience. Van den Elsen is presently pursuing a Grasp of Science (mineral economics) via Curtin College.

Mario Orrego – Technical Guide and QP

Mario Orrego is a geologist and a registered member of the Chilean Mining Fee. He’s a Certified Particular person as outlined by Nationwide Instrument 43-101.

Adrian Manger – Non-executive Chairman

Company finance govt with 35 years of minerals business expertise, comprising 20 years in govt and management roles with BHP, together with the $US1-billion growth of the Spence copper mine in Chile. Manger has substantial enterprise expertise in South America. He’s a co-founder and director of assorted enterprise enterprises in Australia, Chile and Peru, with non-public and public financings exceeding $30 million. Manger led or participated in company finance transactions involving entity gross sales to public corporations; IPO of SensOre, RTO of Pampa Metals; merger to type CopperEx; financings from HNW’s Funding Financial institution & Personal Fairness; and a number of business transactions. He holds a public directorship with SensOre (ASX:S3N), main the appliance of AI/ML to minerals exploration. He’s a founding board member of the Australia Colombia Enterprise Council; former board member of Fundación Buen Punto, a Colombian not-for-profit neighborhood sports activities basis geared toward using iconic sports activities to foster sports activities diplomacy and peace for underprivileged youth and youngsters; and former committee member of the Bogota Bulldogs Australian soccer membership.

Julian Bavin – Director

Julian Bavin has 30 years of technical, operational and business expertise in mineral exploration gained from work in a variety of commodities, jurisdictions and cultures, most of which was spent with the Rio Tinto Group in South America, Australia, Indonesia and Europe. From 2000 to 2001, he was the enterprise growth govt for the Industrial Minerals Group in Rio Tinto, progressing alternatives in Europe and South America. From 2001 to 2009, he was the exploration director for the Rio Tinto Group in South America and accountable for the groups which recognized the potential in a spread of tasks now in numerous levels of feasibility, together with the Rio Colorado potash and Alter copper/gold tasks in Argentina, the Mina Justa, Constancia and La Granja copper tasks in Peru, and the Amargosa bauxite undertaking in Brazil. After South America, he moved to London as Rio Tinto’s exploration director accountable for Africa, Europe, the Center East and the Former Soviet Union, with a short that included the Jadar lithium-borates discovery in Serbia (now in feasibility).

Bavin has a Bachelor of Science from the College of Leicester, a Grasp of Science from Imperial Faculty in London and is a graduate of the senior govt program on the London Enterprise College.

Invoice Tsang – Chief Monetary Officer

Invoice Tsang brings greater than 15 years of accounting expertise within the mineral exploration and mining business specializing in monetary reporting, regulatory compliance, inside controls, and company finance actions. Tsang has held quite a few CFO positions with publicly traded entities. He has labored in public observe offering skilled companies and recommendation to publicly traded corporations on the NYSE, TSXV and OTC markets, on numerous public reporting companies, similar to audit necessities, qualifying transactions for reverse takeover, mergers and acquisitions, and financing transactions. Tsang holds a Bachelor of Commerce from the College of British Columbia and is a chartered skilled accountant and chartered accountant.

[ad_3]